We take your privacy seriously. By selecting "Accept All," you consent to the storage of all related cookies on your device. These cookies improve site navigation, analyze usage patterns, and support our marketing and service endeavors Privacy Policy

All fields with an asterisk (*) are mandatory.

All fields with an asterisk (*) are mandatory.

Already have an account?

Sign in hereAll fields with an asterisk (*) are mandatory.

Sign up for an account

Enter your registered email account and we will send you an email containing a link that you can use to reset your password.

All fields with an asterisk (*) are mandatory.

Please enter and confirm your desired new password.

All fields with an asterisk (*) are mandatory.

The range between minimum price and maximum price is incorrect. Please submit the correct range.

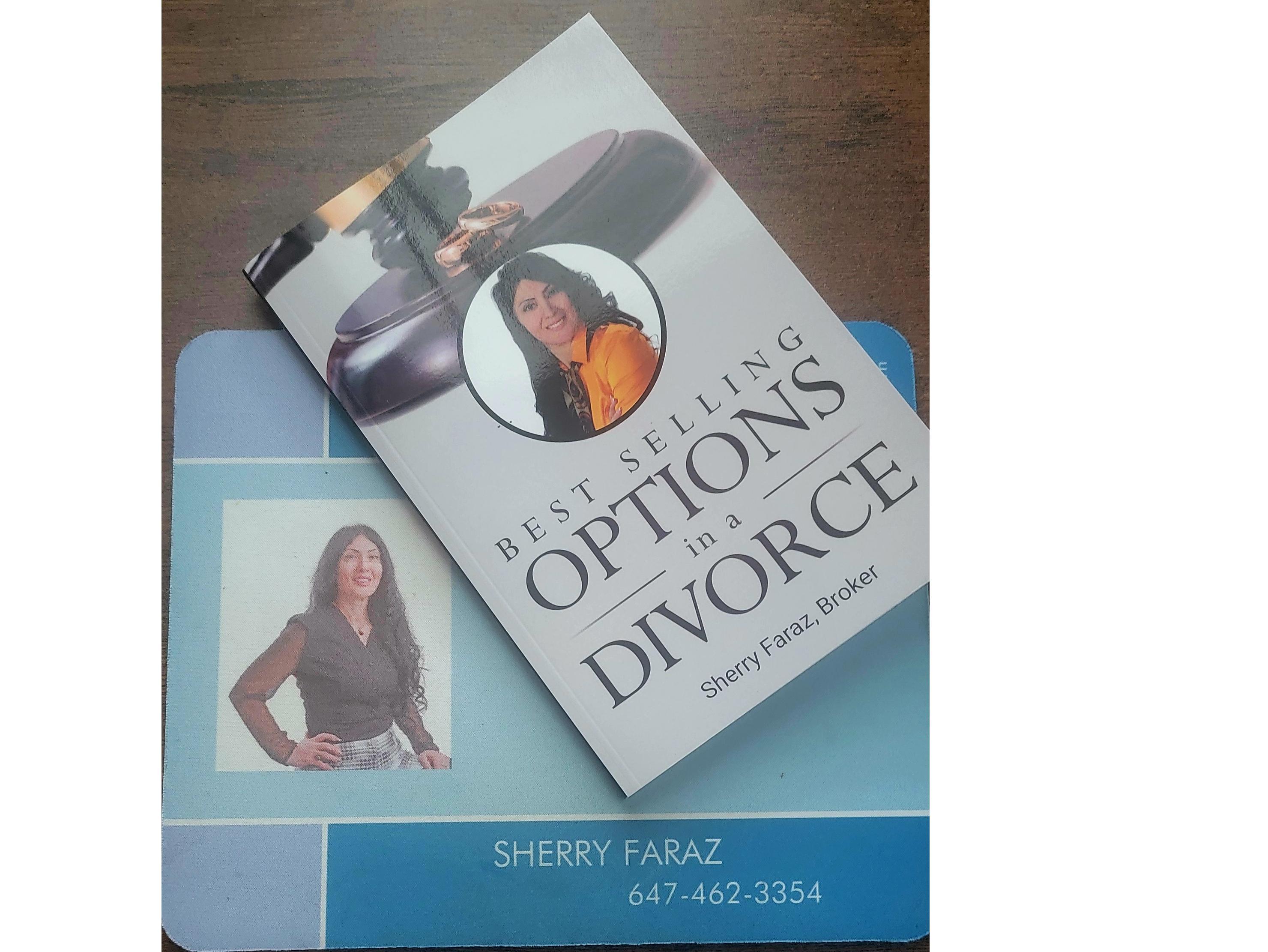

In divorce situations, the couple has to sell their largest asset—sometimes unwillingly. This makes these types of transactions very volatile, and a real estate agent must handle them with the utmost care.

Clients in the midst of a divorce are dealing with significant life changes and stress, which can affect their decision-making process

Both parties may have differing opinions and priorities regarding the sale of their home, leading to conflicts and delays.

Divorce proceedings often come with specific timelines and court-mandated deadlines.

Additional considerations may include splitting proceeds, addressing outstanding debts, and ensuring a fair division of assets.

Clients going through a divorce are likely experiencing a wide range of emotions, from sadness and anger to relief and hope for a new beginning.

Divorce transactions typically involve coordination with legal professionals such as divorce attorneys and mediators, as court orders or divorce settlements may dictate specific terms for the sale of the property.

Clients may be concerned about personal information exposure or their situation being discussed publicly.

Divorce can have significant financial impacts for both parties, such as outstanding mortgages, debts, and tax implications.

Therefore, I understand the importance of

The federal government has announced it will begin using real estate licences as official IDs.The rationale is that not everybody has a driver's licence.

Don’t Buy a Car or New Furniture

Don’t Make Large Cash Deposits or Move Money Around

Don’t Apply for Credit or Increase Your Limits

Don’t Co-sign for Anyone

Don’t Get Behind on Your Payments

Don’t Change Jobs or Careers

Don’t Change Banks

Don’t Close Credit Cards or Max Them Out

Do Save Enough Money for Closing

Do Be Cautious When Consolidating Debt

Do Wait Until You’re Fully Funded Before Making Big Financial Changes

Do Hire a Skilled & Professional Real Estate Agent

Determine the Budget & get a Loan Prequalification.

I can connect you to a Mortgage Specialist

Ask Me what are the differences between prequalification and preapproval

Ask me How you can improve your credit score to help you with your approval

I will explain the entire process

First Home Savings Account (FHSA), a type of tax-free account rolled out by the federal government last year to help Canadians save on their first home.

"Your contributions to the FHSA are tax-deductible, while your withdrawals — as long as you use them for the down payment of a purchase of your first home — are tax-free," said Gerry Vittoratos, a national tax specialist with UFile.ca.

The program allows prospective homebuyers to start saving for up to 15 years once they open an account, with an annual $8,000 deposit cap and a lifetime contribution limit of $40,000.

Canadians who've opened this type of account will receive a new slip called the T4FHSA, which will provide the details needed to complete your tax return, Vittoratos said.

If you own a house, you want your name on the deed. A house deed is an essential document proving that you are your home's valid legal owner. It gives you certain title rights, such as taking out a mortgage or buying, selling, renting, or transferring the house.

People named on the home title have ownership of the house, while those named on the mortgage are responsible for paying for the home loan. The names on both documents are often the same, but this can change if the deed or mortgage is transferred or co-signers are involved.

It’s quite possible to live in a house for years without your name being on either the title or the mortgage. You probably did that very thing from birth until adulthood. But now that you’re a full-fledged grown-up, you’ll be interested in associating your name with the place you call home. This primarily applies to the home’s title, although there are repercussions for not having a part in the mortgage.

Names on the Title

When you sign papers to close on a home, you decide how you want your name to appear on the title. If you’re buying a home as a couple, you decide whether to add both of your names or just one. Often, circumstances change after closing on a home, however. A couple could get a divorce, or a person who bought a home solo may find true love and get married. A solo homeowner could also decide to bring a friend in as a roommate to cut down on the high costs of a monthly mortgage.

Not having your name on your home’s title can be a big deal. If you and your co-occupant decide to part ways, your name is not on the home, so technically, you’re homeless. If you have been paying half of the mortgage for months or years, the money you put into the home is gone. You’ll be forced to move out, and the other person can remain in the home or sell it. Either way, your ex-roomie will eventually be able to sell the home and earn the rewards of any equity it built up over the years. If, however, you share a home with someone who dies, you may find that their death leaves you in a bit of a pickle, especially if you weren’t married. To protect yourself, either get your name on the title through a quitclaim deed or make sure they have a will that turns the house over to you in the event of their death.

Names on the Mortgage

It may sound like a good deal to have your name on a title but be absent of any legal responsibility for paying it, but you’d be wrong. If, for some reason, the person on the mortgage decides to stop paying, you can bet the lender will come after you for the money if your name is on the title, especially if the home is headed toward foreclosure. At the very least, they can seize the home if payments aren’t made, leaving you to make other living arrangements. If the owner does stop paying, you may be able to refinance the home in your own name however.

The risks are even higher for the person whose name is on the mortgage. If the other person is on the title, that person could legally sell his home ownership to someone else without your permission. This would make you co-owner of a house with someone you didn’t choose to own a home with.

If the homeowner dies, the individual who inherits the home can take over the mortgage, even if his or her name isn't on it. This is because the mortgage insures the house, not the person.

Joint Ownership

For couples planning to co-own a home, the safest action is to put the property and mortgage in both names. If you choose to move into a house owned by one of you, you can do this through a quitclaim deed, which ends your ownership rights to that home. You would then create a new deed that names you and your other person as co-owners. However, doing this does not change the names on your home’s mortgage.

If you want to add another person to your mortgage, one of the safest ways is to refinance the loan. You may even get a better interest rate by doing so, significantly if things have changed since you initially took out the loan. It may be easier to create a will that names the other person as beneficiary of the home if you die, especially if you think you might be moving within the next few years.

I will tell you why you should choose me for your needs with no doubt.

Proudly, I believe in myself. I am the right person to walk with you and support you in your real estate journey.

I am working full time and more than 12 hours per day if I need to work.

I work closely with industrial partners to support my clients if they ask.

I believe in teamwork work, so I have ready my list regarding all I need to know about your real estate e situation and conditions

I believe in the value of our time, so we will not waste it as you start to work with me.

I believe there is no better when we can make the best

I value your lifestyle and understand how important it is to make the final decision to purchase or sell the property.

I will prepare you and provide you with necessary and valuable information to knowledge you about the entire process that you are going through

I won't leave anything behind.

I will share and gather all the information you may need regarding my responsibilities and duties.

Conventional mortgage:

Offer a larger down payment, and don’t require mortgage insurance.

Convertible adjustable-rate mortgage

fixed-rate mortgage and an adjustable-rate mortgage

Assumable mortgage

The buyer will take over the seller’s existing mortgage and house-related debt. This might happen if a parent or spouse dies and the heirs take over the mortgage.

Balloon Mortgage

Clients who opt for a balloon mortgage will pay smaller monthly payments at first, followed by one larger-than-typical payment (the balloon) at the end of the loan.

Bridge loan

They got clients who found their dream home before selling their current one? A bridge loan can be a real lifesaver in this situation. Essentially, it’s a short-term loan that helps a buyer cover costs in the interim between buying a new house and selling one. It could also mean you have the chance to be the client’s buying and listing agent!

Cash-out refainance

A homeowner can refinance their property for more than its value and take the added amount as cash. It generally results in a higher interest rate or additional points, but it’s a way for homeowners to leverage their equity in a property.

Co-borrower

Don’t you love it when the co-borrower is the client’s dad who comes along on the inspection and is suddenly an expert on chimney engineering? If your clients are concerned about getting approved for a loan, you can remind them that a co-borrower agrees to back the borrower in a mortgage loan. They sign all of the loan documents, have interest in the property being purchased, and are required to pay the monthly payments if the primary borrower is unable to.

Construction loan

A construction loan is a short-term loan that covers the cost of building a property until the owner can secure long-term financing.

If you sell your home,

Advertising schedules

Appointments and viewings

Feedback from buyers

Feedback from agents

Up-to-date neighbourhood activity

Changing market conditions

All interested prospects

All offers

Our recommendations

Prompt response to all inquiries

Constant follow-up

ANSWERING THE BELOW QUESTIONS WILL HELP ME TO HAVE A BETTER UNDERSTANDING OF YOUR PURPOSE AT THE BEGINNING

What price range are you looking in?

Who has been helping you with your home search?

Are you currently renting your property, or do you own it?

When does your lease end?

Do you need to sell before buying?

I am so excited to announce that I am extremely serious about my journey as a real estate broker to build a strong relationship with industrial partners to provide more support for you as my respected client. We must work closely to build trust to cover all your needs and interests as much as possible. Therefore, there is no doubt that during this fantastic teamwork, we must share /respect and divide the responsibilities to work better.

Let Get Started

Buying a home is a big decision, no matter how much real estate experience you have. To help you make intelligent decisions,

Here are a few tips to get you started.

Keep Budget In Mind; include legal fees, land transfer tax, mortgage insurance and utility hookups in your total cost.

Please know the costs of a home inspection and appraisal or survey.

Moving prices can vary based on volume, distance and whether you hire a professional mover. Have wiggle room in your budget to cover the cost

.

Consider some unexpected ones.

You Need to have a clear picture of the whole process before it begins, to save your time.

.Hasel and money

But no Worries.

I can help you navigate the many steps and decisions involved in home-buying.

WHAT YOU NEED TO KNOW IS :

I WORK HARD ON YOUR REALESTAE NEEDS

1;SELLING YOUR PEOPERTY EITHER FREEHOLD/CONDO/ASSSIGNMENT

2:PURCHASING AS AN FIRST BUYER /NEW COMMERS/INVESTOR/RELOCATING

4:CONDO/PRECONSTRUCTIONS/ASSIGNMENT/FREE

HOLD

5:LOOKING FOR RENTAL PROPERTY

MY AREA OF WORK IS GTA

MY EXPERT IS RICHMONDHILL/AURORA/MARKHAM/VAUGHAN/

NEWMARKET/EAST GWILLIMBURY/AND SIMCOE

OF COURSE I AM WORKING CLOSELY WITH THE INDUSTRIAL PARTHNERS TO SUPPORT YOU BETTER IN THIS PROCESS.

I AM NOT GOINGTO MISS ANY ITEMS OF YOUR NEEDS WHEN YOU SHARE WITH ME THOESE IMPORTANCE ONES

I won't be satisfied with a good result when we could make a better choice . Therefore, I need your help to reach the best result by learning more about your Real Estate Needs & Situation.

So by sharing more, you will let me offer you my best service during your journey

LET'S GET STARTED

Buying or selling a home is a big decision - you need an experienced professional to guide you through the process. When you work with me, you can count on personal, attentive, patient service, excellent knowledge of the area, great negotiation skills and expert selling strategies.

Homeownership COST

The deposit

down payment

Closing costs …..

Understanding your mortgage

As a professional real estate broker, my goal is not only to buy your dream home or sell your home for more dollars.

I believe I have more responsibilities. To be on top of my goal, I work closely with my industrial partners as my team, who can support you in this process

, so to reach this importance, I need your help.

Post all your real estate questions, and I will share them with my team

you can find your answers by following me on my Facebook page

Thank you for your inquiry.

Your request could not be submitted.

Create your Client Portal account or sign in to favourite listings, save searches and sign up for automatic email notifications.

what is the FHSA

FIRST HOME SAVING ACCOUNT

If you fit the three requirements, you likely qualify. But if you are looking to buy a second home or a new home as a previous homeowner, this account isn't for you.

You are considered a first-time homebuyer, for the purposes of this plan, if you haven’t owned a home within the last four calendar years.

For example, if you bought your first home in 2015 and sold it in 2018 and have been renting or living with parents or a non-spouse ever since, you would be considered a first-time homebuyer again.

What happens if you don't use your FHSA?

If you don't use your FHSA to buy a home, you can transfer the funds to an RRSP account anytime within 15 years or at the time you need to close your account. The transfers will not impact your RRSP’s contribution room.

Alternatively, you can withdraw the amount, but the funds would be subject to with

Who doesn’t qualify for the FHSA?

If you fit the three requirements, you likely qualify. But if you are looking to buy a second home or a new home as a previous homeowner, this account isn't for you.

You are considered a first-time homebuyer, for the purposes of this plan, if you haven’t owned a home within the last four calendar years.

For example, if you bought your first home in 2015 and sold it in 2018 and have been renting or living with parents or a non-spouse ever since, you would be considered a first-time homebuyer again.

What happens if you don't use your FHSA?

If you don't use your FHSA to buy a home, you can transfer the funds to an RRSP account anytime within 15 years or at the time you need to close your account. The transfers will not impact your RRSP’s contribution room.

Alternatively, you can withdraw the amount, but the funds would be subject to withholding taxes.

If you are planning to buy a home in the next few years and don’t have enough time to earn the maximum amount of $40,000 in the FHSA, you still could still use your savings from the account in combination with the other new tax proposals.

The federal government also announced that the First-Time Home Buyers' Tax Credit will increase to $10,000, which provides up to $1,500 in direct homebuyer support.**

Plus, the First-Time Homebuyer Incentive, which allows new owners to lower their monthly payments, has been extended until March 31, 2025.

Living in an area you like is as important as buying a home you love. Do you want a busy urban lifestyle, a house in the ‘burbs, or a quiet place in the country? Do you want to walk to work or are you okay with a longer commute? Do you need to be close to good schools? Rec facilities? Shopping?

Go to open houses. Visit mls.ca. Check the classifieds. Drive around neighbourhoods you like looking for For Sale signs. Talk to your REALTOR® about your needs and start looking at properties.

Put together the right group of experts to help you buy. Start with a REALTOR® you trust, then look for a reputable lender or mortgage broker, a lawyer (or a notary in Quebec), a home inspector and an insurance broker. Your REALTOR® works closely with all of these professionals, and will be happy to recommend people you can depend on.

You’ve found the perfect place – now it’s time to make an offer. An offer to purchase includes the purchase price you’re offering, chattels to be included in the purchase (like appliances or light fixtures), the amount of the deposit, the closing date and any other conditions.

Your REALTOR® will help you prepare your offer, and will present it to the vendor, who will either accept it or make a counter offer (which asks for a higher price or different terms). You can accept or reject the counter offer. If everyone agrees, the home is yours. If not, you can make another offer, or you may have to keep looking.

Once you’re approved, you’ll need to decide what type of mortgage works best for your needs. Will you go with a fixed or variable interest rate? Will your mortgage be closed or open? What will your amortization period be? Will you make payments monthly, biweekly or weekly? Your mortgage broker or lender can help you find a mortgage that suits your needs – and saves you the most money in the long term.

Trademarks owned or controlled by The Canadian Real Estate Association. Used under licence.

Copyright© 2025 Jumptools® Inc. Real Estate Websites for Agents and Brokers